The Basic Principles Of Offshore Trust Services

Wiki Article

6 Easy Facts About Offshore Trust Services Explained

Table of ContentsAn Unbiased View of Offshore Trust ServicesThe 2-Minute Rule for Offshore Trust ServicesOffshore Trust Services Things To Know Before You Get ThisUnknown Facts About Offshore Trust ServicesSome Known Factual Statements About Offshore Trust Services Not known Facts About Offshore Trust ServicesSome Of Offshore Trust ServicesThe Greatest Guide To Offshore Trust Services

Private creditors, even larger private firms, are a lot more amendable to resolve collections versus borrowers with challenging as well as effective property protection plans. There is no possession security strategy that can prevent a very motivated lender with unlimited money and persistence, yet a well-designed overseas trust fund often provides the debtor a favorable settlement.Trustee business bill annual fees in the variety of $1,000 to $5,000 each year plus per hour rates for extra solutions. Offshore depends on are not for every person. For many people staying in Florida, a residential possession protection strategy will be as reliable for a lot less cash. For some people encountering difficult creditor troubles, the overseas count on is the best choice to secure a considerable quantity of assets.

Borrowers may have more success with an overseas depend on plan in state court than in an insolvency court. Judgment financial institutions in state court litigation might be frightened by offshore property protection counts on as well as might not look for collection of properties in the hands of an overseas trustee. State courts lack territory over overseas trustees, which indicates that state courts have limited remedies to buy compliance with court orders.

The 20-Second Trick For Offshore Trust Services

debtor documents bankruptcy. A personal bankruptcy debtor should give up all their possessions and also lawful interests in property wherever held to the bankruptcy trustee. Personal bankruptcy courts have globally territory and are not hindered by international nations' refusal to acknowledge basic civil court orders from the united state. An U.S. bankruptcy court may force the personal bankruptcy borrower to do whatever is needed to commit the bankruptcy trustee all the debtor's possessions throughout the world, including the borrower's valuable interest in an offshore trust.Offshore asset protection counts on are much less reliable against internal revenue service collection, criminal restitution judgments, and also family members support obligations. 4. Even if an U.S. court does not have jurisdiction over offshore trust possessions, the U.S. court still has personal territory over the trustmaker. The courts may try to force a trustmaker to liquify a count on or restore trust properties.

The trustmaker needs to be prepared to surrender lawful civil liberties and also control over their trust possessions for an overseas depend on to effectively shield these properties from U.S. judgments. 6. Option of a professional and dependable trustee that will certainly safeguard an overseas depend on is more vital than selecting an offshore trust fund jurisdiction.

8 Simple Techniques For Offshore Trust Services

Each of these nations has trust fund statutes that are beneficial for overseas possession security. There are refined lawful differences amongst offshore count on territories' legislations, but they have much more attributes in usual. The trustmaker's selection of country depends mainly on where the trustmaker really feels most comfortable placing properties. Tax obligation therapy of foreign offshore trusts is extremely specialized.

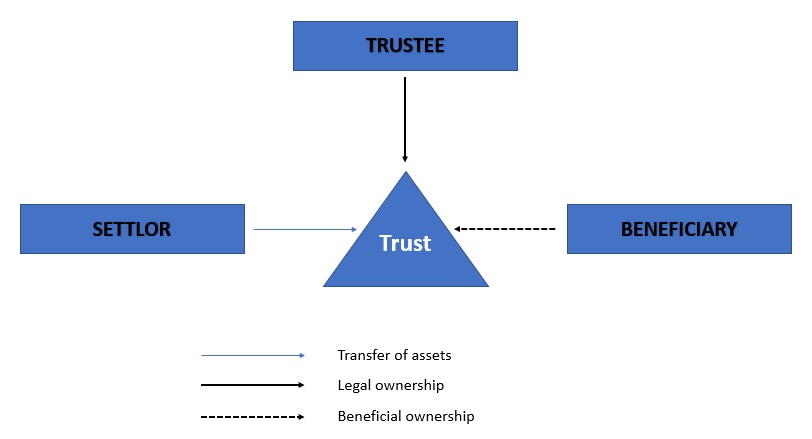

An overseas trust fund is a traditional trust fund that is formed under the regulations of an overseas territory. Typically offshore counts on are comparable in nature and also result to their onshore counterparts; they involve a settlor moving (or 'resolving') possessions (the 'trust fund home') on the trustees to handle for the benefit of a person, class or individuals (the 'beneficiaries') or, sometimes, an abstract purpose.

Liechtenstein, a civil jurisdiction which is in some cases thought about to be offshore, has actually synthetically imported the count on principle from common regulation territories by law. Official stats on counts on are challenging ahead by as in many offshore jurisdictions (as well as in most onshore territories), counts on are not needed to be registered, nevertheless, it is believed that one of the most usual use overseas trust funds is as part of the tax and also monetary preparation of well-off people as well as their households.

7 Easy Facts About Offshore Trust Services Explained

In an Unalterable Offshore Trust might not be altered or liquidated by the settlor. An allows the trustee to choose the circulation of revenues for different courses of beneficiaries. In a Set trust, the distribution of revenue to the recipients is taken care of and also can not be altered by trustee.Confidentiality as well as privacy: In spite of the fact that an overseas count on is officially signed up in the federal government, the events of the trust fund, properties, and the problems of the depend on are not videotaped in the register. Tax-exempt standing: Assets that are transferred to an overseas trust fund (in a tax-exempt offshore zone) are not exhausted either when transferred to the depend on, or when transferred or redistributed to the beneficiaries.

An Unbiased View of Offshore Trust Services

This has actually additionally been carried out in a number of U.S. states. Rely on general go through the regulation in which gives (briefly) that where count on residential or commercial property includes the shares of a firm, after that the trustees must take a positive function in the affairs on the business. The policy has actually been criticised, however remains part of trust fund legislation in numerous common law jurisdictions.Paradoxically, these specialized types of trust funds appear to infrequently be used in connection to their original designated uses.

Specific jurisdictions (especially the Chef Islands, however the Bahamas additionally has a types of asset protection trust) have actually supplied special counts on which are styled as possession defense trusts. While all trusts have an asset defense component, some jurisdictions have actually passed regulations attempting to make life difficult for financial institutions to useful source press insurance claims versus the trust (for instance, by offering especially short constraint durations). An overseas trust fund is a device utilized for property protection as well as estate preparation that functions by moving properties right into the control of a legal entity based in another nation. Offshore depends on are unalterable, so trust fund owners can not redeem ownership of transferred possessions. They are additionally complicated and also costly. For people with greater liability concerns, offshore counts on can supply protection and also greater privacy as well as some tax benefits.

Offshore Trust Services Things To Know Before You Buy

Being offshore adds a layer of defense as well as privacy as well as the ability to take care of taxes. Because the depends on are not located in the United States, they do not have to follow United state laws or the judgments of United state courts. This makes it much more hard for creditors and litigants to go after cases against possessions kept in overseas depends on.It can be challenging for 3rd parties to identify the possessions as well as proprietors of overseas trust funds, our website that makes them aid to privacy. In order to set up an overseas count on, the initial step is to select an international country in which to locate the trust funds. Some preferred areas include Belize, the Chef Islands, Nevis and also Luxembourg.

Getting The Offshore Trust Services To Work

Transfer the properties that are to be shielded right into the depend on - offshore trust services. Offshore trusts can be useful for estate planning and also property defense but they have restrictions.residents that establish offshore trusts can not leave all tax obligations. Earnings by properties put in an offshore trust are without U.S. tax obligations. U.S. citizens who obtain circulations as recipients do have to pay U.S. income taxes on the circulations. United state proprietors of overseas trusts also need to file records with the Internal Income Service.

Things about Offshore Trust Services

Corruption can be an issue in some nations. Furthermore, it is necessary to pick a country that is not most likely to experience political discontent, regime modification, financial turmoil or fast changes to tax obligation plans that can make an offshore depend on much less beneficial. Asset defense depends on normally have actually to be developed before they are needed.They also do not flawlessly secure against all cases and Visit This Link also may reveal proprietors to risks of corruption as well as political instability in the host nations. Offshore trust funds are useful estate preparation and also asset security devices. Comprehending the correct time to utilize a particular trust, and also which count on would certainly provide the most benefit, can be complicated.

Take into consideration utilizing our resource on the counts on you can utilize to profit your estate planning., i, Supply. com/scyther5, i, Supply. com/Andrii Dodonov. An Offshore Trust fund is a customary Trust formed under the regulations of nil (or low) tax obligation Worldwide Offshore Financial Facility. A Trust is a legal video game strategy (comparable to a contract) wherein one person (called the "Trustee") in accordance with a subsequent individual (called the "Settlor") grant acknowledge and hold the home to assist different individuals (called the "Beneficiaries").

Report this wiki page